Cross-Market Intelligence

VWAP, OHLCV and Trade Count

VWAP (Volume-Weighted Average Price)

Overview

VWAP is a trading benchmark that calculates the average price of a security, factoring in both its price and volume. It gives a weighted average price where the weights are the volumes traded at each price point. VWAP is significant as it provides insight into both the trend and value of the cryptocurrency.

Mathematical Background

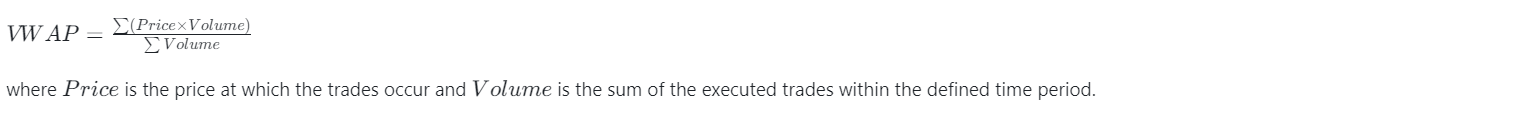

VWAP is calculated using the formula:

Metric in the API Response

vwap: This metric returns the VWAP of a specific trading pair over a defined period (selected in gran parameter).

OHLCV (Open, High, Low, Close, Volume)

Overview

OHLCV is a consolidated metric representing five critical pieces of information about market’s trading activity in a specified time period (1m or 1h - defined by gran parameter)

Metric in the API Response

open: The first price for an executed trade within the defined granularity period

high: The highest price for an executed trade within the defined granularity period

low: The lowest price for an executed trade within the defined granularity period

close: The last price for an executed trade within the defined granularity period

volume: The sum of the executed trades within the defined granularity period

Trade Count

Overview

Trade count is a metric that measures the total number of trades executed for a particular trading pair within a specific timeframe (granularity). This metric is useful for assessing market activity and liquidity.

Metric in the API Response

tradecount: This metric provides the total number of trades that have occurred for a specific trading pair in a given period.

Example

{

"timestamp": "2023-12-27T00:00:00.000Z",

"marketvenueid": "okx",

"pairid": "btc-usdt",

"open": 42513.2,

"high": 42537.1,

"low": 42513.2,

"close": 42520.3,

"volume": 7.7443,

"vwap": 42519.5964,

"tradecount": 606

}

Usage Example and Visuals

Analyzing the market data for okx-btc-usdt on December 27, 2023:

- Retrieve the VWAP, OHLCV and the trade count to understand the average price, price movement and trading volume and gauge market activity and liquidity.

- Vizualise the data to enhance the understanding of market trends and behavior

-

OHLCV Chart: This panel shows the Open, High, Low, and Close prices of Bitcoin for each time interval. The prices are relatively stable with minor fluctuations within the period. The market does not show any significant price spikes or drops, indicating a relatively stable trading period.

-

VWAP (Volume Weighted Average Price): The VWAP line appears to be above the closing prices initially, indicating that earlier trades were happening at prices above the average. However, as time progresses, the VWAP gets closer to the closing price line, suggesting that the trading prices are aligning more closely with the average. This could mean the market is stabilizing or that volume is decreasing.

-

Trade Count: The bar chart at the bottom represents the trade count during each time interval. There’s a significant peak in the middle of the period, indicating a period of high trading activity. This spike could be due to a news event, market announcement, or other stimuli causing a sudden increase in trading interest.

Based on this visual information, we can infer that during the observed time period, the Bitcoin market experienced a phase of relatively stable prices with a period of increased trading activity in the middle. The VWAP trend suggests that the price movement was near the average traded prices over time, showing no significant divergence from typical trading patterns.

Applications in Market Surveillance

-

Establishing Baselines: OHLCV, VWAP, and Trade Count provide baseline understanding of market activity. Significant deviations in these metrics can indicate anomalies.

-

Volatility Context: OHLCV range and VWAP provide context around observed volatility metrics. Wide price ranges with volatility can signal manipulation efforts.

-

Wash Trading Detection: Analyzing OHLCV, VWAP, and trades can identify potential wash trading, such as prices not impacting VWAP.

Considerations for Cryptocurrencies

- Higher volatility increasing variability in OHLCV metrics

- Lower liquidity exaggerating individual trade impact on VWAP

- Changing participant profiles influencing trading volumes

Key Takeaways

- OHLCV, VWAP, and trades provide pricing, volume, and activity baseline.

- Significant deviations may signal anomalies.

- Contextualizes other metrics like volatility and trade sizes.